Menu

Table of contents

Those are pretty big differences. How can these different tools vary so much? Which tool is right? And which one should you rely on?

High time to clarify that.

Before we begin: what is search volume?

Some know exactly what it is and others may think of the level of the sound system: volume. Often it is still not entirely clear what is meant by the term search volume.

Search volume is the number of times a search term is searched each month. In other words, the number of searches per month where a particular keyword is used.

In many of these cases, search volume is an average of the past 12 months. That way you catch any hypes, trends and seasonal search (which, by the way, is not always an advantage and especially if you sell seasonal products or services).

Why search volume matters

Keywords are the basis of content and therefore the basis of your SEO strategy. This is because you need to know which terms you want to rank for and which words to use to do so.

To arrive at a good keyword, there are four things to look at:

- How often is a keyword searched for (Volume)?

- How difficult is it to rank for a keyword? (Level of difficulty)

- What is people's intent when they use a keyword?

- How relevant is this keyword to my business?

These four always go hand in hand. In fact, a keyword with 20 volume per month may be extremely interesting for your business because a) there is virtually no competition present, b) the keyword is very relevant, and c) people also have a buying intention when they use the keyword.

So search volume is incredibly important because it indicates which words might be of interest.

What programs can you use to find out volumes of keywords?

Being tool crazy, I have already written several blogs about different tools you can use to find out keywords.

So my best blog on this topic is really: 15 best keyword research tools [Free + Paid].

Of these 15, these are currently the best programs for me in terms of keyword tracking:

As you know, I am not a fan of the Google Keyword Planner. But since it is an important tool, I will include it in the rest of my blog anyway.

By the way, there are many other little programs that can figure out the search volume behind a particular search term, but these are, in my opinion, the best or most widely used tools today. Therefore, I am focusing on these 6 for now.

What volumes do the tools indicate on 5 different keywords?

If you're a business owner using one program, you won't notice it. But if you do a lot of SEO, then you recognize this problem:

You are doing a keyword analysis and in tool X the volume is 500 and in tool Y the volume is 20. You test this on a few more keywords and what turns out?

Virtually no search volume matches...

To demonstrate this, I have used five different keywords in the table below. Five different keywords based on four different types of customers I have and one external one:

1. A generic Dutch keyword with targeting Netherlands

2. A specific (local SEO) keyword with targeting Netherlands

3. An English keyword with targeting worldwide

4. One English keyword with targeting America

5. The keyword Remon Hendriksen of Internet Impact mentioned as an example on LinkedIn (targeting Netherlands).

| Quinoa (1) | Bookkeeper Amsterdam (2) | Plant based protein (3) | Business intelligence (4) | CBD Oil (5) | |

| SEMrush | 27.100 | 880 | Worldwide not possible. | 18.100 | 3.600 |

| KWFinder | 26.500 | 800 | 76.200 | 17.800 | 41.100 |

| Ahrefs | 23.000 | 400 | Worldwide not possible. | 27.000 | 39.000 |

| Ubersuggest | 27.100 | 880 | Worldwide not possible. | 18.100 | 0 |

| MOZ | No data | No data | Worldwide not possible. | 9.300-11.500 | 30.300-70.800 |

| Google Keyword Planner | 27.100 | 880 | 74.000 | 18.100 | GKP does not accept this keyword. |

To be perfectly honest, I'm not entirely dissatisfied with what I see above. Of course there are differences between them, but overall this is not too bad.

Only with the term CBD oil do we see considerable differences. In my view, this has a number of reasons:

- You may not advertise on CBD oil in Google (and so the Keyword Planner does not show volumes)

- CBD oil has grown rapidly in popularity in recent years (i.e., it is hype)

So in the case of CBD oil, you won't have much use for the search volumes provided by the various tools. That information is worthless.

With the other keywords, it does help you. So it will depend entirely on your industry, niche and your keyword whether the data you see is accurate.

The reason why there is a difference between the volumes of keywords

The reason for the difference is actually quite straightforward. It has to do with how the tools get their data.

For example, SEMrush states on their website that they use the following methods:

- Data from so-called data providers (clickstream data) that share all search results for the 500,000,000 most popular keywords

- Analyzing the top 100 on those keywords

- Analyzing the free and paid search results

- Historical data they already have

- The Neural Network Algorithm (an algorithm that recognizes patterns in data)

- The data SEMrush gets from clients when their clients link organic traffic insights

Clickstream data

Before I go any further, let me explain the term clickstream data. When you google 'how does semrush get its data' or 'how does ahrefs get its data', you often see clickstream data popping up. Clickstream data is nothing more than the data collected from website visitors. This data is collected in all kinds of ways. Think of websites you visit, programs you use, etc.

And now on to the methods the tools use to arrive at their search volumes.

KWFinder (part of Mangools) does it in a very different way again. Maros Kortis, head of marketing at Mangools, admits to Quora that they get their data mainly from Google and use parties such as MOZ and Majestic.

And Ahrefs states on its website that they have their own crawlers, use the largest database of backlinks and also like SEMrush get their data from data providers (again, based on clickstream data).

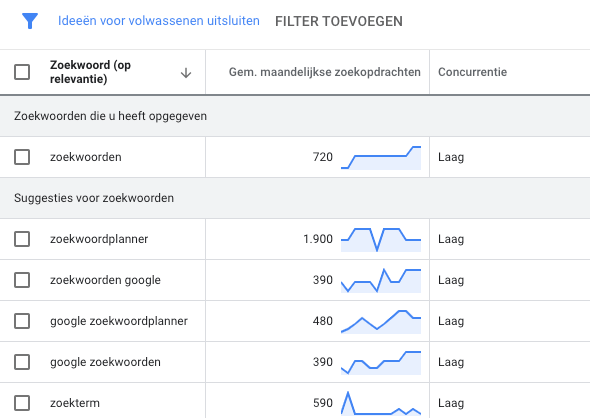

When we talk about Ubersuggest, we can be fairly brief about that. Those get all their data from the Google Keyword Planner. And the last one, MOZ, also works from the Keyword Planner and data providers (and thus with clickstream data).

How best to choose a keyword when all volumes differ?

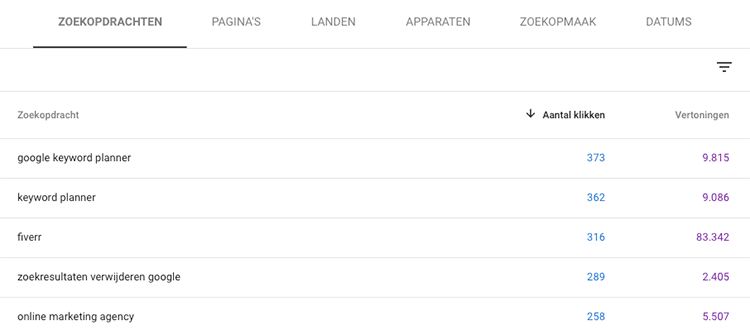

I've said it before and I'm going to say it again: don't stare blindly at the search volumes the tools give you. For example, first look around Google Search Console to determine what keywords you are already being shown on.

If you are sure your target audience is using a certain term, but the tools indicate a volume of 0 or 10, always go by your gut. This works especially well for local parties where local SEO is very important.

We still have clients where we use keywords that the tools don't know about (and thus don't give us volume), but we still bring in clients.

For that, we use Keyword Hero, for example. With this we can link the search term that someone entered in Google to a conversion and thus we can see which terms convert and which do not.

So use the tools as a guide and, if you can, use multiple tools. If the Keyword Planner, SEMrush and Ahrefs indicate that there is at least 400 volume on it, then I consider it very likely that this is really the case.

And don't forget competition, intent and relevance when choosing a keyword!

In my opinion, which keyword tool is best?

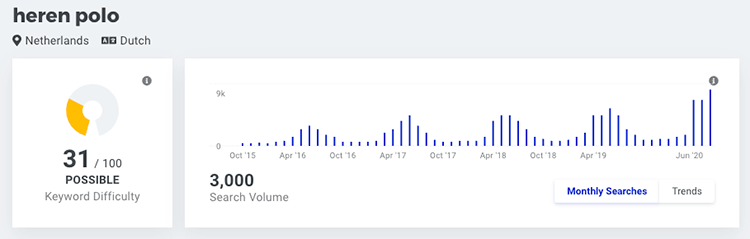

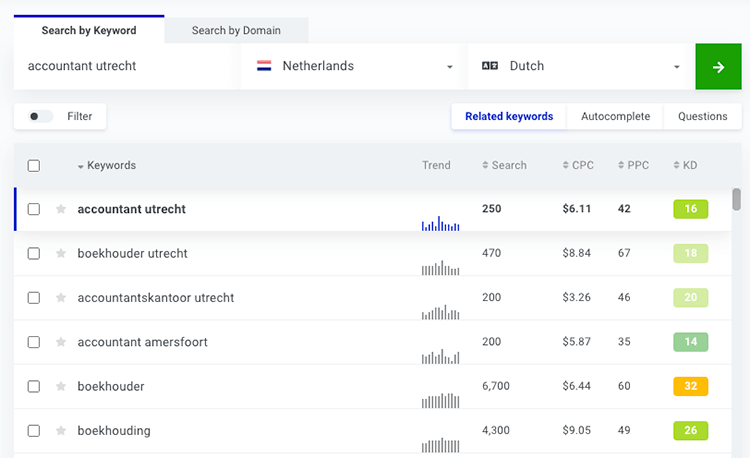

My go-to search tool is currently KWFinder. I do the bulk of my research with that. This has to do not only with the search volume, but also with the way the tool works: fast, convenient and it all looks very calm.

When I want a quick indication of the search volume of a keyword, I don't use any other tool. When I am doing a full keyword research, I always grab SEMrush as well. Purely because SEMrush has so many methods to get good data.

Does that mean KWFinder and SEMrush are currently the best? Opinions are divided on that. But personally, I find KWFinder and SEMrush work best and I get the best results with them.

Bonus: blogs on figuring out and determining keywords

Should you want to know more about keywords, doing keyword research and choosing keywords, for example? Then I recommend the below previously written blogs of mine:

2 Responses to "This is why search volume varies by keyword tool"

Good and clear story Daniel. I do doubt the claims of SEMrush a bit. Either their clickstream data is limited. After all, they give the exact same volumes as the Keyword Planner.

Of course, that could be a coincidence, but you could also be right! SEMrush will not be 100% transparent about that....