Menu

Table of contents

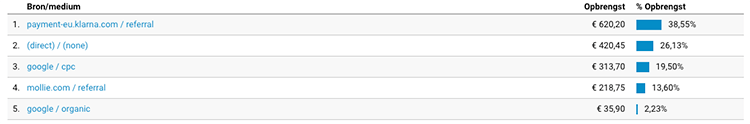

As a result, you don't know exactly which effort is yielding what. And so that has to be solved.

In this article, I'm going to tell you all about that.

What are payment providers?

A payment provider is nothing but a party that facilitates a digital payment. The most well-known examples are Mollie, Multisafepay and Adyen.

Payment providers then enable payment via iDeal, Klarna, bank transfer, Bancontact and a host of other payment options.

In short, no webshop can do without it.

Why are conversions assigned to payment providers?

The answer to this question is actually super simple. When you land on a website via Google, Google Analytics sees it as organic traffic.

When you visit a website via a link from another website, Google Analytics sees this as a referral. And when you click on a Google Ads ad, Google sees this as paid search.

That all makes a lot of sense.

If you landed on an online store via Google and then want to make the payment, you will be redirected to the payment environment of the payment provider.

You then complete the payment and are redirected to the thank you page. Google Analytics then no longer sees that you initially came to the website through Google, because you came back through the payment environment of the payment provider.

So Analytics sees this as two different sessions and thus says that the revenue comes through the payment provider (i.e., referral) and not through Google.

Roadmap for excluding payment providers in Google Analytics

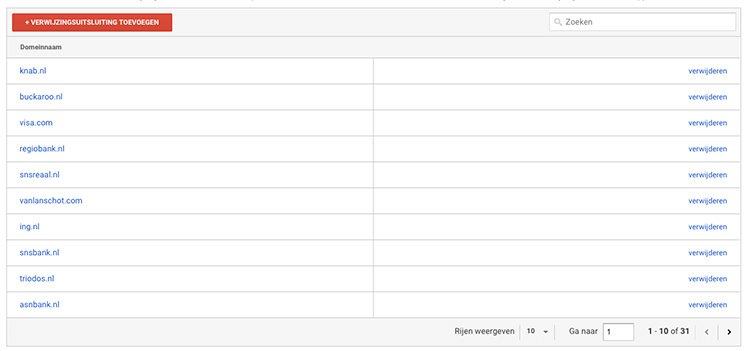

Fortunately, this problem is not unknown to Google Analytics and they have come up with something for it: referral exclusions.

Adding payment providers to this list removes them from Analytics and automatically allocates revenue to the channel that really caused the sale.

Which in turn allows you to know exactly how well (or badly...) your campaigns are doing.

And now I'm going to explain to you step by step how to exclude a payment provider from Google Analytics:

Step 1: log in to Google Analytics

Step 2: Click on the account and on the property where you want to add the referral exclusion.

Step 3: Click on "administrator" at the bottom left.

Step 4: Click on 'Trackinginfo and then 'list of referral exclusions'.

Step 5: Click the button marked '+ add referral exclusion'.

Step 6: Add the payment provider you want to exclude and click 'create'.

Step 7: Repeat steps 5 and 6 just as many times until you have had all the payment providers.

Now of course you can add your known payment providers in the way I explained above. But do you actually know what all the payment providers are? I have listed them for you.

List all the payment providers you want to exclude in Google Analytics

I've scoured the entire Internet to find all the payment providers for you and I've compiled them into one long list. So that you don't have to figure out exactly which payment providers you use:

3ds.bnpparibas.com

3dsecure.icicibank.com

3dsecure.icscards.com

abnamro.com

acs2.swedbank.se

acs4.3dsecure.no

asnbank.nl

banking.ideal.ing.nl

belgium-3dsecure-uvg.wlp-acs.com

belgium-3dsecure.wlp-acs.com

belgium-uvj-3dsecure.wlp-acs.com

pay.rabobank.com

bitpay.com

cap.attempts.securecode.com

cap.securecode.com

checkout.buckaroo.com

services.asnbank.nl

services.regiobank.nl

giropay.sparkasse-lev.de

ideal.asnbank.nl

ideal.bunq.com

ideal.bunq.nl

ideal.ing.nl

ideal.knab.nl

ideal.regiobank.nl

ideal.snsbank.nl

ideal.triodos.nl

ideal.vanlanschot.com

live.adyen.com

mollie.com

multisafepay.com

mycardsecure.com

pay.mollie.com

pay.multisafepay.com

pay.com

payment-web.sips-atos.com

paypal.com

regiobank.co.uk

secure.curopayments.net

secure.ogone.com

secure5.arcot.com

securecode.abnamro.nl

securecode.com

securesuite.co.uk

securesuite.net

secureyou3d.ing.be

sicher-einkaufen.commerzbank.de

sicheres-bezahlen.bw-bank.de

snsbank.co.uk

sparkasse-lev.de

tsys.arcot.com

verifiedbyvisa.com

wlp-acs.com

Written by: Daniel Kuipers

Daniel is the founder of Online Marketing Agency. He constantly scours the Internet for the latest gadgets and tactics and blogs about them in understandable language. Well, sometimes.